The Krause Agency is a national wholesaler of insurance products designed for the senior market. Our asset preservation strategies help agents and advisors provide meaningful solutions to clients planning for long-term care or seeking supplemental healthcare coverage.

WHAT WE OFFER

We offer specialty products, unparalleled service, and exclusive resources to help you grow your business and achieve success. Our main priority is helping you develop financial solutions that work for your clients’ specific needs.

SPECIALTY

PRODUCTS

No matter your client’s situation, we offer products to help them get the coverage they need.

UNPARALLELED

SERVICE

From the initial quote to overcoming potential roadblocks, we are with you every step of the way.

EXCLUSIVE

RESOURCES

In addition to our products, we provide the education and training needed to use them effectively.

HOW WE HELP

If you aren’t sure which product or service is best for your client, we can help. We provide the support, education, and training you need to help your clients plan for their care costs and achieve peace of mind as they age.

INDUSTRY-LEADING RESOURCES

When you work with The Krause Agency, you know you’re working with the best. We are committed to providing you with the resources you need for every case. From quick LTCI quotes to state-specific Medicaid figures to our popular eAcademy webinar series, we offer the essential tools you need to master the senior market.

PERSONALIZED DASHBOARD

Create Your FREE Agent Access account to gain access to exclusive product resources, including white papers, Medicare Search & Save, LTCI quoting tools, and more.

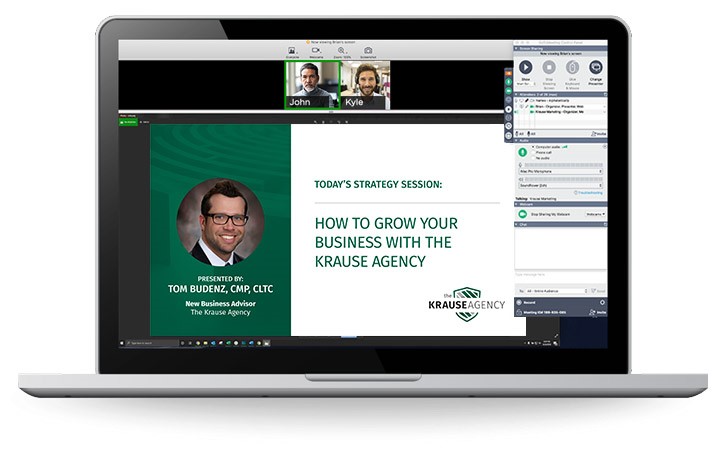

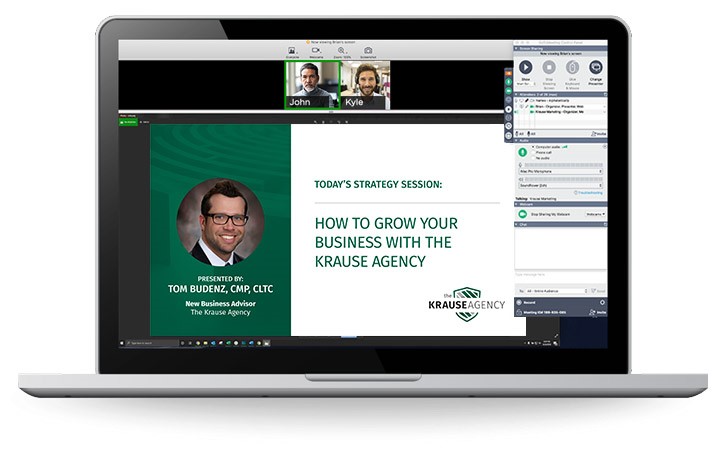

eACADEMY WEBINARS

Our live eAcademy webinar series focuses on solving challenges agents face with their clients. Join us live or watch on demand for real solutions, case studies, and Q&A with reliable speakers.

VIDEO TRAINING LIBRARY

Designed to bolster your growth, our videos break down complex topics into straightforward and understandable concepts.

OUR LATEST AGENT GUIDE

Our comprehensive Agent Guide is a must-have for agents, whether you specialize in MCAs, LTCI, or Medicare products.

EXCLUSIVE WHITE PAPERS

Gain in-depth insight into key topics that affect growing your business successfully. Topics range from nurturing referral relationships to the specifics of Medicaid Compliant Annuity planning.

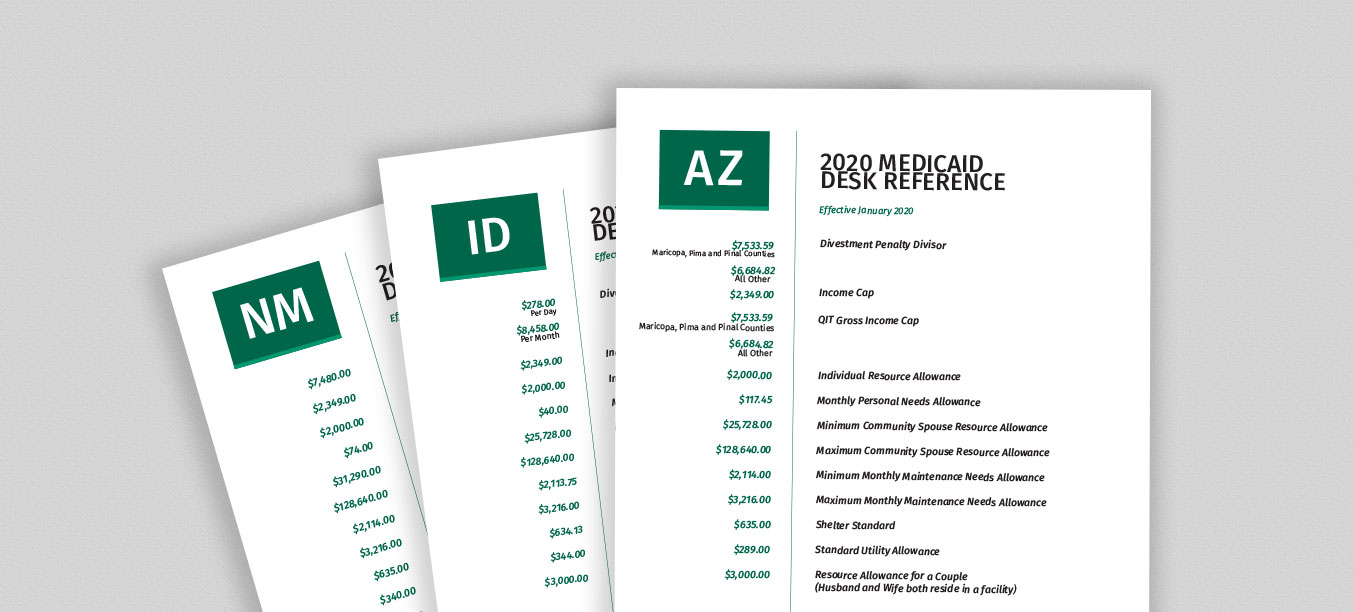

STATE-SPECIFIC RESOURCES

When it comes to crisis planning, your state’s specific rules are key to achieving the best result. We’ve compiled state Medicaid planning figures and Medicaid manuals for easy access.

CREATE YOUR FREE ACCOUNT &

GET INSTANT ACCESS TO OUR EXCLUSIVE RESOURCES!

When you sign up for a free Agent Access account, you can take advantage of exclusive resources, such as our full webinar library, LTCI quoting tool, Medicare Search & Save, and state-specific Medicaid figures.

HOW WE WORK TOGETHER

Schedule a Discovery Call

If you want to know more about incorporating any of our products into your business, book a free consultation with one of our experts. You’ll learn how The Krause Agency acts as your partner throughout the process, whether it be through planning guidance, marketing support, or finding new clients. In short, you tell us your pain points, and we’ll tell you how we can help solve them.

WHAT OUR AGENTS ARE SAYING

We have been working with Krause Financial for more than a decade. Krause’s office has been instrumental in facilitating our Medicaid planning process. Whenever we have a complicated plan, Krause is there to help answer our questions with unsurpassed knowledge and professionalism. We greatly appreciate our relationship, and it has been mutually beneficial for a long time. Krause is a valuable asset to our practice.

Joshua M. Barron, JD, AIF

JMB Financial Services Group

The Krause Agency is wonderful to work with. When you are engaged in highly technical elder law strategies, it’s important to know that everyone is on the same page and has the background to execute the plan correctly on a timely basis. It’s a team effort which requires a strong supporting cast when engaging in Medicaid planning. That’s why we work exclusively with The Krause Agency.

John D. Hale

Attorney at The Hale Law Firm, P.C.

I have been working with The Krause Agency for 7-8 years now. I have found them to be easy to work with. Their staff is very knowledgeable regarding the Medicaid rules. Customer service and follow-up are very important to me, and the staff at Krause always returns phone calls and replies back to emails in a timely fashion. They are a pleasure to work with

Joe Hamel

President of Hamel Advisory Services, LLC

I have been working with The Krause Agency for over 2 years now in conjunction with some of the top elder law attorneys in Northeast Ohio. I would recommend The Krause Agency to any agent looking to work with elder law attorneys that need Medicaid compliant annuities. The staff is top notch and makes the process a breeze.

Craig Hannus

Ohio Insurance Agent

In the last two years I have used Krause Agency for ELCO Medicaid Compliant Annuities. I have found Krause Agency "Truly Outstanding" in the area of Agent Support.

Edgar Wilde

Life Insurance Broker

OUR BLOG

Beyond our products and services, we aim to provide up-to-date information on what’s happening in the senior market. Stay tuned to our blog for posts centered around long-term care, Medicaid, Medicare, and other industry-related topics.

Spring Into Action: Developing a Sales Prospecting Campaign to Increase New Business

What Is Sales Prospecting? Sales prospecting is a technique employed by sales professionals to generate customer leads that fit their...

Who Is a Good Candidate for Long-Term Care Insurance?

More than 50% of Americans turning 65 years old will require long-term care services and supports, which means that everyone...

What’s New in Medicare Products?

Are you staying up to date with the latest and most innovative Medicare solutions? In recent years, the landscape of...

CREATE YOUR FREE

AGENT ACCESS ACCOUNT TODAY!